According to CBInsights, pricing/cost issues are the #5 reason for startup failures. In the beginning, it is not uncommon for entrepreneurs to ignore negative margins. However, such an approach can, in the long run, prove to be very costly.

The start-up expenses play a huge role since your business will not take off without the right amount of capital. By estimating your start-up costs, you can determine if your business plan is feasible and the amount of financing you may need. This article explains how and why assessing costs is fundamental for your company’s long-term viability and explores some international companies that terminated/slowed down their operations because of cash flow problems.

Big picture

“As success has a price, operations have a cost”

The Cost Structure describes all costs incurred to operate a business. Minimizing costs is an approach which every company should adopt, yet there are 2 extreme categories a business can fall into:

Cost-driven: this approach aims at creating and maintaining the leanest possible Cost Structure, using low price Value Propositions, maximum automation, and extensive outsourcing.

Value-driven: this approach contains premium Value Propositions and a high degree of personalized service.

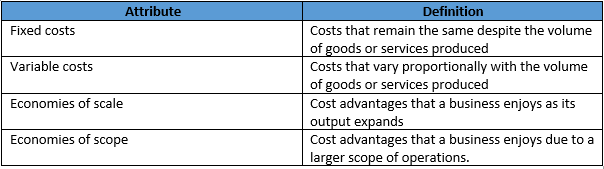

Following are some basic but important characteristics:

Important questions

Prioritizing costs and ranking them by amount can help you conclude which ones must be changed.

What are the most important costs inherent in your business model? Which Key Resources are most expensive? Which Key Activities are most expensive?

SWOT Cost assessment

Using this familiar tool in combination with the business model canvas, we can determine that costs belong to the internal environment and thus opportunities or threats may result from the analysis of the section.

With the table below, you can assess your own cost structure:

Strengths

Do you have a cost-tracking system?

Is your cost structure better than your competitors?

Weaknesses

Do you have any major cost streams which cannot be matched to a Key Activity?

Threats

Which costs threaten to become unpredictable?

Which costs threaten to grow more quickly than the revenues they support?

Opportunities

Where can we reduce costs?

News & Examples

In the following section, we will name notorious companies which, in one way or the other, encountered cost issues during their effort to success. Loss leaders are the idea that losing money can build a customer base, which will increase profits in the long-term.

Starting big, the most striking case of the last year is WeWork.

While multiple reasons can be attributed to the recent fiasco of the real estate company, it is important to mention that the business went overboard losing $1.25 billion in the 3rd quarter of 2019 alone, largely from acquiring new offices that are hemorrhaging money at an impressive rate.

Other big names in the negative-margin club are:

Uber – The company is still making a loss due to having to subside its rides and other platform operations. Profitability is set to 2021.

Slack – The business is not far from its era of profit making but for now it remains one of the bigger companies struggling to reach the plus margins.

Snap Inc – The parent company of Snapchat, has been making a loss since it started, and despite having quite a high valuation, still registers red in the bottom line.

Startup Takeaways

1. Your startup’s cost structure reflects directly on two essential financial metrics: cash burn rate and cash runway.

2. If your business requires high costs to run, but you can’t design equally high revenue streams, you’ll face problems in sustaining and scaling it.

3. Cost structure mapping helps you on visualizing significant costs and thinking about alternatives to reduce them.

4. The relation of cost structure with other business model blocks shows you the impact that iterations or pivots have on your financial results.

Costs will remain a major concern for any kind of business at any stage, whether they will become a problem depends on your approach and ability to change. Minimizing costs is not the only strategy you can adopt!

Would you like assistance in creating a game-changing cost structure? Apply for an intake with Innovate Today.

References

Anastasia. (2015, March 20). Cost Structure Block in Business Model Canvas. Retrieved from Cleverism: https://www.cleverism.com/cost-structure-block-in-business-model-canvas/

Austin, D. (2019, November 25). Why WeWork Failed — And What It Means for Coworking. Retrieved from Medium: https://medium.com/@derek_develops/why-wework-failed-and-what-it-means-for-coworking-5d6bb209f5e2

Azevedo, A. (2019, August 13). What Is Your Startup’s Cost Structure? Retrieved January 6, 2020, from The Traction Stage: https://thetractionstage.com/2019/08/13/what-is-your-startups-cost-structure/

Rossington, R. (2019, November 7). 5 Of The World’s Biggest Companies That Are Making Zero Profit. Retrieved from CEO Today: https://www.ceotodaymagazine.com/2019/11/5-of-the-worlds-biggest-companies-that-are-making-zero-profit/

Upcounsel. (2019). Cost Structure Example Startup: Everything You Need to Know. Retrieved January 6, 2020, from Upcounsel: https://www.upcounsel.com/cost-structure-example-startup

Written by Steven Pango

steven@innovate.today